We are in a fascinating period of the LNG market. Advancing technology in the industry, combined with the influx of entrants on the supplier side create an environment rife with challenges and opportunities.

US and Global Project Highlights

The advance of technology and supply within the U.S. is a well-documented reason for the growth of the LNG market. Consequently, competition across LNG suppliers are at historic levels. Here is a snapshot of the global activity.

Liquefaction facility owners are diversifying in size and scope

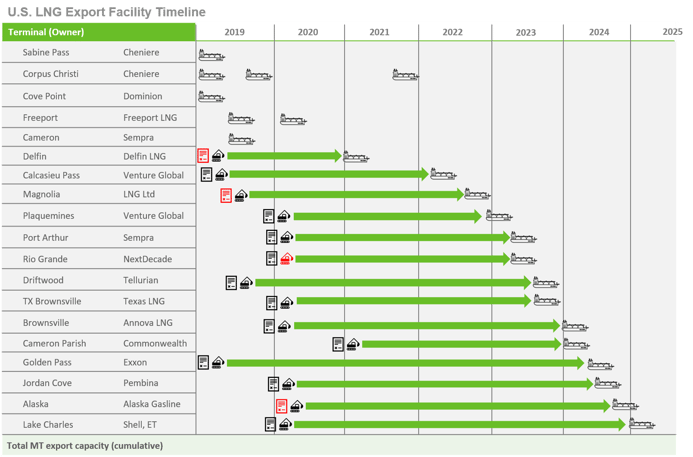

The U.S. has a steady stream of liquefaction projects expected to come online through 2025 and both small and medium sized terminals are increasingly proposed, permitted and reaching FID. The speed with which a smaller terminal can be completed and offer returns make these facilities an attractive model.

Liquefaction advances and models are not limited to the U.S.

New entrants outside of the U.S. are also making headway. Projects across North America, Africa, and the Middle East are also ramping up, many with 2022-2024 estimated start up dates. Shell, Exxon, and Total have committed investment dollars in one or more of Russia’s new liquefaction plant buildouts. Qatar and Australia are (interchangeably) the top two LNG exporting countries are acting to maintain their position in the market. Qatar LNG is planning a fourth train to its facility; slated to add 32Mtpa to the current export capacity (77Mtpa as of 2019). The state-controlled company plans to meet that goal by 2024. In Australia, one project expansion is expected to reach FID in 2020 and operational by 2024. Another brownfield development is projecting a 2021/2025 FID-to-operations timeline.

Strong outlook for both buy-side and sell-side participants

In spite the increase of supply-side entrants, the opportunity for healthy returns remain. Forecasts of long-term growth through additional buy-side participants, an attractive price premium and profitability outlook and the discovery of cost efficiencies, all contribute to these proposed projects.

Spot market adds flexibility

Vessel efficiencies has facilitated a shift in short-term market. Better bunkering and higher LNG capacity allow suppliers to send ships to take advantage of the spot market. In parallel, voyage optimization technologies create cost-effective paths to deliver quantities on DES terms.

How to Adapt and Gain an Advantage

With all of this in play, suppliers are incentivized to be very efficient and optimize at every critical point in the process. This begins well before the first molecule is delivered to your buyer. Here are a couple of ways suppliers can take advantage of increased LNG production.

1. Plan Early and Evaluate Continuously

The factors of a supplier are numerous and layered. Location, supply term and credit are just three broad factors to consider when deciding what buyers to transact with. Market outlook, financing, upstream gas supply potential power obligations, tolling, delivery terms and vessel considerations are some of the numerous additional elements a supplier must assess. With all these factors at play, it is imperative to define functions of the business, identify the integrations and determine the optimal course of action.

Getting the right people in the room is vital in ensuring success for such a large undertaking. A coordinated effort allows the company to determine the proper course of action without unintentional omissions.

Each of these factors named and unnamed are dynamic. The evaluative process starts early and continues throughout the life of the company. The frequency for which evaluation is performed is also established early and adjusted as needs change.

2. Find Opportunity and Optimize

In any competitive environment, the most successful companies find ways to find opportunity and optimize. Opportunity can arise as a result of a sudden unforeseen event; however, rigorous planning and evaluation is the more common way to extract opportunity. Managing physical gas procurement is one way optimize as a supplier. A complete gas hedging strategy can complement gas procurement by managing the impact of price changes across short-term and long-term contracts.

In summary

These are just two of many areas where a supplier can find opportunity throughout the life of the business. As the business matures from pre-operations to operations, opportunities exist throughout, and the most successful companies maximize these opportunities.

At Veritas Total Solutions, we have strong expertise in LNG strategy & transformation services. If you are interested in learning more about our specific capabilities, contact us to learn more or subscribe to our blog to stay connected.