Buyers of any commodity face a dilemma: lock in supply at the risk of favorable outcomes through competitive bidding, or maintain flexible contracting with the risk of unfavorable price and/or supply shortages. Of course, decisions are made based on the acceptable risk tolerance and operational goals.

The current liquefied natural gas (LNG) landscape has allowed buyers to explore a range of previously unavailable contracting options. In turn, buyers are leveraging this power to optimize opportunities and pivot when necessary without sacrificing long-term supply. However, flexible contracting options create complexity. A thorough understanding of the options and a complete strategic plan supported by the right technology to execute business objectives create an environment where it’s possible to navigate these complexities and flourish. Here are some areas of flexibility buyers should consider.

Contract Terms

Going back to traditional (first wave) LNG structures, 20-year LNG contracts were par for the course. Now, buyers are negotiating shorter terms, gas-indexed pricing and off-take optionality. These considerations add flexibility for the buyer to lock in supply volumes and to explore spot cargoes for changes in demand and/or pricing and enable them to dynamically manage inventory. Additionally, spot LNG supply intended for short-term needs or integrated into a buyer’s long-term strategic plan adds another option buyers can explore to diversify supply.

Suppliers are increasingly more willing to contract under these terms as they also see opportunity through flexibility. In addition, global super-majors and majors are moving forward with projects under equity lifting models and are not obligated to obtain long-term contracts to satisfy financiers’ requirements.

Pricing Structures

The composition and breadth of pricing has increased. Legacy Brent or other oil-indexed contracts are no longer the best proxies of market value. Several hubs are gaining as pricing indices for LNG contracting. Identifying the hubs that are gaining momentum can be integral to making the best decisions that align with buyers’ strategic goals.

JKM

The JKM is rising in the number of cleared transactions, asserting that the market itself has enough liquidity to provide reliable pricing. Increasing interest and activity for JKM is proving this to be true. However, it is too early to anoint this marker as a global pricing benchmark.

TTF vs. NBP

European TTF-indexed pricing is on the rise. There are several factors driving the shift to TTF. In Europe, storage capacity and the corresponding seasonality creates a dynamic landscape to price the forward market. In relation, NBP is experiencing liquidity erosion and increasing spreads to TTF. Limited storage and resulting UK demand decreases liquidity around the NBP and its prominence as an attractive marker. Geopolitical uncertainty (Brexit) also plays a noticeable role in buyer-side preferred contract pricing. Spot gas priced at TTF vs. NBP is also gaining ground. Volatility around spot pricing at NBP has been higher than TTF, making the TTF-NBP spread even more pronounced in the spot market, further indicating TTF is more aligned with the “true” market price.

HH vs. Waha

In the U.S., HH and Waha also have well-documented spreads. Easing pipeline constraints at Waha has been the solution for narrowing spreads and increasing liquidity at that hub. As these upstream volumes are liquified, the role of stateside pricing may have increased significance globally.

How to Leverage Opportunity

With this broader landscape, buyers should take care to thoroughly review their options to ensure they are well positioned to meet their business objectives. The following actions will aide buyers in selecting the most favorable opportunities.

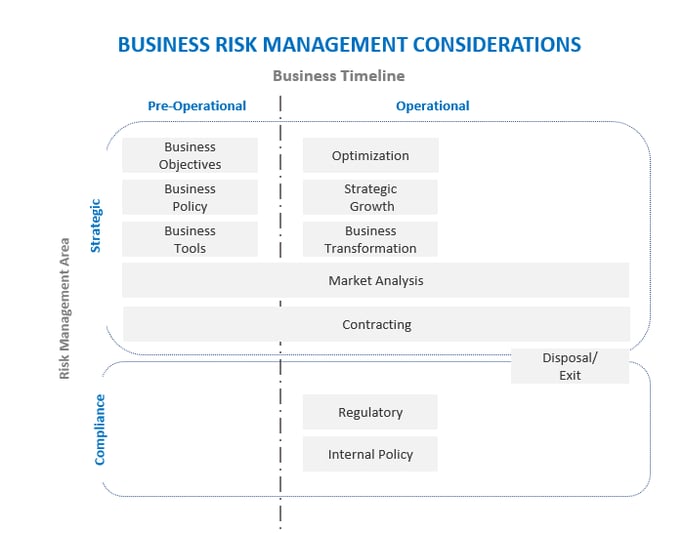

1. Develop a Strategic Plan Inclusive of Risk Management

Contract flexibility and pricing variance adds uncertainty and complexity to a business. These factors can be daunting to tackle, considering how these decisions can affect a company substantially. This means prior to making the first decision, leadership must be thorough and intentional in developing a comprehensive strategy that identifies the goals with precision, applies an approach diligently, and communicates the plan effectively.

A well-developed strategy works in parallel with comprehensive risk management. Strategy answers the questions of what to do and how to do it, while risk management calibrates the “how” and provides leadership clarity to make decisions that are aligned with business policy.

Applied to the trends in terms and pricing, strategy and risk management can help buyers identify options to determine the best path forward.

For example, pricing spreads across global benchmarks introduce both risk and opportunity. Through strategic risk management, the company analyzes spreads and individual benchmark sensitivities to determine its overall tolerances against both. The company may elect to transact through an index and engage in hedging activity for price protections. Strategy is deployed to identify the proper indices and the structure of the hedging program to meet specific and broad goals.

Policy and administrative risk management can support the strategic initiative by ensuring there is proper training, robust monitoring of positions, an adequate approval matrix, a plan for corrective action, regular review of the program to ensure alignment with business objectives, and proper reporting to internal and external stakeholders.

It is important to note that while strategy and risk management are interdependent, a firm may have a clear strategy with a weak risk management platform, or vice versa. This circumstance is more common than people may think. However, overcoming this mismatch requires a complete evaluation of both areas and thorough planning to integrate and align both concepts.

2. Have the Right Technology Place

Another important factor in managing demand complexity is having technology in place that supports the efforts of the business. In an instance where an LNG buyer is evaluating to negotiate shorter contract terms to leverage mid- and long-range flexibility, software technologies including market demand analysis, custom pricing curves and valuation tools, as well as deal modeling/simulation, can help identify the best options.

At Veritas Total Solutions, we have strong expertise in LNG strategy & transformation services. If you are interested in learning more about our specific capabilities, contact us or subscribe to our blog to stay connected.