At the end of every year, I look at where all of my money went, and I evaluate my return on investment for every expenditure. This year’s top investment was an electric guitar for the oldest child. He has gotten so good in such a short amount of time, that he is playing with a group of kids in this year’s high school talent show. I love seeing the computer science nerd branch out into the arts. This year’s worst investment was a robotic lawnmower. The cost of the robot itself was substantial, and we cannot seem to get the robot to run consistently. Our yard is a disaster.

So, the “traditional investment” of a musical instrument paid off and the “digital investment” costs me thousands, with nothing but aggravation to show for it….hmmm….I wonder how many CIO’s are looking at their 2019 expenditures and drawing similar conclusions when it comes to digital investments.

It is a new year, and a new opportunity to track and measure your investments. Before opening your pocketbook and investing in digital transformation, carefully consider your return on investment (ROI). In a lot of cases, ROI can be hard to quantify. However, when ROI is really there you should be able to see it even if it’s not tangible or physically measurable. In order to quantify your investments, consider the following:

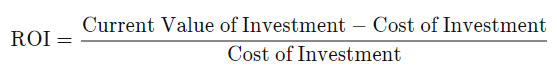

Calculate your ROI

You need to quantify your ROI in comparison to the expenditure. To calculate your ROI, simply divide the benefit of the investment by the cost of the investment.

Come up with a value for “value”

In most cases, it’s easy to come up with the cost of the investment. That’s simply what you spent to purchase the product (plus any on-going costs of course). The “value” can be a little trickier. Take the example of my child branching out beyond his normal computer science world. There is immeasurable value in the fact that he has expanded his horizons and tried new things. This is not measurable, and in this case, we can’t’ quantity the value.

Factor in indirect benefits that are not measurable

Sometimes the ROI is not inclusive of secondary benefits (outside of the core value it delivers) that the digital investment made have had. While these aren’t factored into the ROI, they should be taken into account as a value add to the organization. Here is some example of how automation and digital investments can add value to an organization outside of the ROI:

- Attract top talent – Automation and investment in innovation can make your company more attractive to potential recruits

- Reduce costly employee turnover – Automation can make people’s day-to-day jobs more enjoyable, which could lead to better attrition rates

- Help improve accuracy and controls – Automation takes out the human error element, which can also save you from regulatory fines

Consider on-going costs as part of the expenditure

Always look past the cost of the product itself. The likelihood that your digital investment has on-going costs, well, is…likely. For example, when considering the cost of implementing Robotics Process Automation (RPA), you must consider the ongoing costs to maintain the solutions or the potential cost of the solution producing erroneous results.

Compare ROI against the same time period

Yes. When comparing the ROI of one investment to another, you should use the same time frame or one investment could seem more efficient even though it has a lower ROI. ROI should be used in conjunction with the Rate of Return, which takes into account a project’s time frame and is expressed by a percentage.

Make this an ongoing exercise

If you have a project that has been in progress for six months or more, it is time to review the project goals, expenditures and value add to your organization. We are in an age of rapidly changing markets and technology. What made sense just six months ago, may or may not make sense today.

In Conclusion

Calculating and monitoring the ROI on your technology expenditures is highly recommended and what better time to start than in the New Year? Without comparing ROI (or Rate of Return) across investments, you will not have clear insight into which investments are performing well and which ones are not. By following these considerations and asking yourself these questions, you will optimize your expenditures in 2020.

At Veritas Total Solutions, we help clients select, implement and manage different types of technology solutions and make sure that they are maximizing the value that they are getting out of these investments. If you are interested in learning more about our specific capabilities, contact us to learn more or subscribe to our blog to stay connected!