Commodity Trading and Risk Management (CTRM) systems have evolved tremendously over the past decade. They offer numerous benefits over more informal solutions such as Excel spreadsheets.

Many have the capability to maintain physical and financial data in one solution across all functional areas allowing visibility and insights into the organization. They empower people at all levels and allow operational efficiencies while simultaneously providing increased controls and reducing risk. Realizing the maximum benefits from a CTRM system requires choosing the right one.

Picking a CTRM system should not be based on a web search to discover what systems are available or going with the system because a similar company uses it. Selecting the right solution is a major decision that deserves careful consideration. The cost of a system including implementation is often hundreds of thousands to millions of dollars. The wrong system potentially leads to pain points, ranging from costly enhancements and poor user engagement to unrealized benefits, failed implementations and a short life.

The most impactful thing you can do to select the right system is go through a formal and structured selection process. Organizations often make mistakes even after an informal selection process. We have found that the four most common and harmful mistakes are not considering future needs, failing to understand the key differences, focusing only on license cost and not engaging the organization during the selection process.

One: Consider Future Needs

Often companies mistakenly choose a CTRM system based on current requirements. However, making a decision based on current requirements does not account for what will become critical capabilities as a company grows. Thinking about the future state of a business allows decision makers to select a system that has the ability to handle changing business models and organizational capabilities.

Focusing requirements on current business needs and current business processes limits the life expectancy of the CTRM system solution. As the company matures, it then must bolt-on systems to handle increased functionality. Or, it has to go through the costly exercise of enhancing or replacing a system it recently implemented. Depending on your business strategy, it may be quite important to consider a CTRM system’s flexibility and extendibility, i.e. its ability to adapt to meet your (currently unforeseen) future needs.

We recently worked with a private investor backed refiner that wanted to move from spreadsheets to a commercial system. A decent portion of their income came by operating as a merchant tolling plant. This type of business model led to high demands and complexities around logistics tracking. However, their leadership recognized opportunities to increase margin by hedging volatile commodity and energy prices and being more opportunistic around market conditions. An increased focus on financial instruments and risk management led to a completely different set of requirements for their future business model. They were able to choose a system that will support their business as it transforms and grows.

Two: Focus on Differentiators

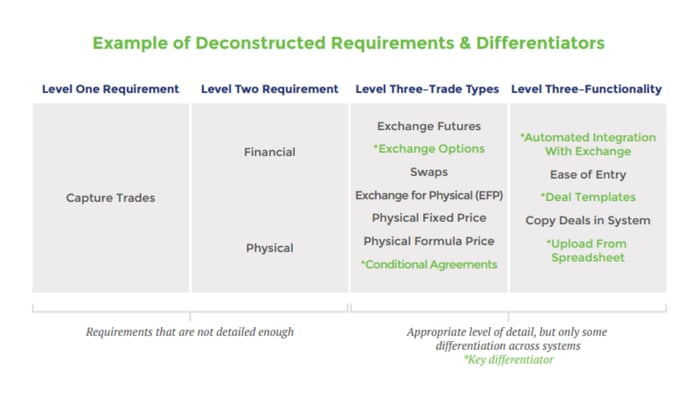

When evaluating a range of CTRM systems, comparing systems often proves difficult because the functionalities sound the same. Every system, for example, has the capability to capture a trade. However, looking at the types of trades a business handles is the level of detail needed to differentiate which system will best serve specific business needs. Decision makers must go beyond surface level marketing to sufficiently understand how CTRM systems compare where it matters for a company. In our experience, CTRM system demos are much more productive if they are centered around “use cases” (aka business scenarios), which allow your stakeholders to see in detail how each alternative system will address your needs. These use cases should represent the 10-15 most important (and representative) processes that should be managed in the new system.

If your firm manages physical assets without use of financial derivatives, you are concerned with different details than a firm that augments income from physical assets with complex financial trading. In addition to the type of deals that need to be captured, other factors such as the volume traded and market system integration are also significant considerations. A firm with large trade volumes may want to facilitate loading those trades from an excel spreadsheet or an easy to use trade blotter. They may also require real time interfaces with exchanges to capture trades. Conversely, companies with small trade volume may not need to over invest in sophisticated trade capture solutions. The key is identifying the unique considerations for your organization and understanding which requirements differentiate one system from another.

Veritas recently worked with two companies on system selections. One company transported a large volume on rail and trucks. They required a system that could allow their logistics team to easily schedule a large volume of transactions. The other company primarily leveraged pipelines to move products. Nearly all systems can handle trucks and pipeline movements. However, not all of them handle those equally. Each organization was able to focus vendor demonstrations on the respective logistic scenarios. They choose appropriate systems that the logistics team bought into and ultimately saved them time and effort.

Three: Understand Total Cost

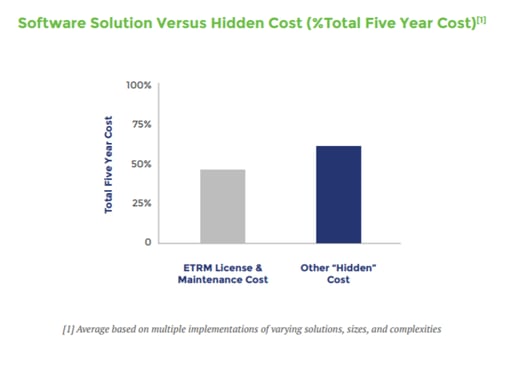

Decision makers often misunderstand the true total cost of a CTRM system. When that happens the expected return on investment falls short and leadership becomes frustrated. Careful analysis of all costs is important to set expectations as well as compare vendors against each other. Vendors often focus on licensing and maintenance cost. When evaluating licensing and maintenance costs be careful to understand the assumptions and terms. Many licenses are based on the number of users. Be sure that all vendors are assuming the same number of business users for comparative purposes. Also, clarify whether IT and support team members need licenses. Additionally, be sure to understand the cost of future licenses and support that may need to be added to support an expanding or changing business.

Hidden costs are even more dangerous than unclear license and maintenance cost. Some CTRM solutions rely on having third party licenses. For example, reporting solutions for management summaries such as Citrix a third party application are used to enable servers, or external risk models for advanced calculations. Third party licenses can enhance functionality, but may also contribute significantly to cost.

It is also necessary to consider the IT infrastructure cost. Different solutions require varying amounts of server and infrastructure requirements. It is important to get an estimate of infrastructure requirements and price that out appropriately when considering the full cost of the solution.

The last but greatest area of concern is the cost of system implementation and post-implementation support. Both are difficult to analyze because they are dependent on complex assumptions including approach and quality. However, these costs can often be as much as license and maintenance fees. We have found that developing an implementation plan as early as possible including resource mix, approach and estimated timeline will help identify these hidden costs. Allow vendors to provide input and background based on specific analogous experiences. In addition, define the post-implementation support model. Who will answer the users’ basic day-to-day questions? What happens when questions need to get escalated? Once you define the model, work to understand what each vendor will provide so that you can have equal comparisons for the same level of service whether the solution vendor is providing it or not.

Integration to other systems is also another cost that can be underestimated in both initial development and ongoing support. Other systems, e.g., financials or planning, need to be integrated and often have been customized to match your particular working environment. Integrating to them may involve the use of sophisticated software development kits (SDKs) and expensive consultants to properly connect. Maintenance costs often escalate when custom integrations are made.

We recently worked with a company on a two-year transformation that included a major phased CTRM solution implementation. At the start of the transformation a careful 4-week system selection phase was conducted. Based on a structured system selection approach we were able to provide leadership andinvestors a full cost that came within 5% of the actuals after 2 years.

Four: Engaging the Organization

Selecting a new system involves the buy in of the users. Enrolling and engaging key users during the selection process is important. Inclusion of key stakeholders in the evaluation process will highlight potential areas of process nuances or improvement that may have been otherwise overlooked. However, the most important aspect is instilling a sense of shared process and priority by your executive sponsor and other stakeholders. We have found that without an enterprise-wide engagement process that includes the user community, it’s often difficult to get consensus going forward.

Executive support is critical to buy in of the rest of the organization. Projects have much less risk of failure in adoption if the executive team clearly states the project’s strategic importance, and maintains a high level of interest in the project outcome. In the absence of executive support, users will often make different judgements about their priorities, and project participation and progress will suffer. It is also important to understand your organization’s natural impediments to change. We led a large global program for an integrated energy company whose traders depended on custom spreadsheets for mission-critical daily processes such as tracking exposure and financial performance. Once the requirements of these “shadow systems” were fully discovered and addressed, it was possible for the trading organization to adopt the new CTRM system.

Conclusion

CTRM systems serve as a critical support tool to help people within an organization to achieve a company’s business goals. Selecting the right CTRM system requires leadership with foresight, as well as in-depth analysis. Avoiding common mistakes pays dividends by positioning a company to capture future growth opportunities and to optimize their current business.

At Veritas Total Solutions, we offer a range of CTRM System solutions. If you are interested in learning more about our specific capabilities, contact us to learn more or subscribe to our blog to stay connected!