The energy industry is truly global. The location of the buyers, sellers, and the actual commodity can be in any corner of the earth. It is without question that the purchase and sale of energy commodities are transacted in numerous currencies.

Many companies are faced with managing business transactions across currencies. For some, it may be the result of a rare or infrequent transaction. For others, it may be a necessity of the business. Either way, the accounting and reporting functions must be prepared to accurately maintain books in the identified currencies. Here is an overview of currency conversion topics and actions to help you maintain accurate records.

Currency Categories

There are three defined and widely accepted accounting currency categories: local, functional, and reporting. Transactions can operate in all three spaces, or two, given two categories are designated with the same currency. These designations have an important purpose and order. The functional currency is typically aligned with the nation or area of central business or economic transactions. The reporting currency is exactly as stated, the currency that the business elects to report its financials. It may or may not be aligned with the country where the company is domiciled or performs its primary business transactions. The local currency is identified as a currency separate from the currency the business transacts or reports in.

A Finnish company with global headquarters in Switzerland obtains a loan from a Japanese bank. The note and repayment terms are denoted in yen. The company elects to report in USD for U.S.-based investors.

Remeasurement vs. Translation Actions

Sometimes the terms "remeasurement" and "translation" are interchanged; however, these terms define a particular conversion action. Remeasurement is the action of recording the changes to account balances as the result of foreign exchange fluctuation. Remeasurement is often associated with individual transactions and time differences between contractual obligation/recognition and payment. Accounts are remeasured to the functional to reflect the financial effect of a transaction as if it occurred in the functional. Consequently, the business will record remeasurement gain or loss to the P&L.

Translation is the effort associated with reporting statements and records from the functional currency to the reporting currency. The key difference is translation is not impacted by fluctuations as transactions have been recorded in the functional. Care must be exercised to ensure the effects of the translation are properly recorded and consolidation can occur.

Sequencing Categories and Actions

Broadly, remeasurement is associated with a local-to-functional currency relationship. Translation is associated with a functional-to-reporting currency relationship. (Intercompany transactions between functional and reporting are eliminated prior to reporting.)

The sequence in which currencies are converted matters. If a company operates across all three currency domains, it is essential to first remeasure from the local to the functional, then translate from the functional to the reporting. Disregarding the order of the conversion and attempting to remeasure from the local to the reporting currency hides the parties performing the transaction and may distort earnings.

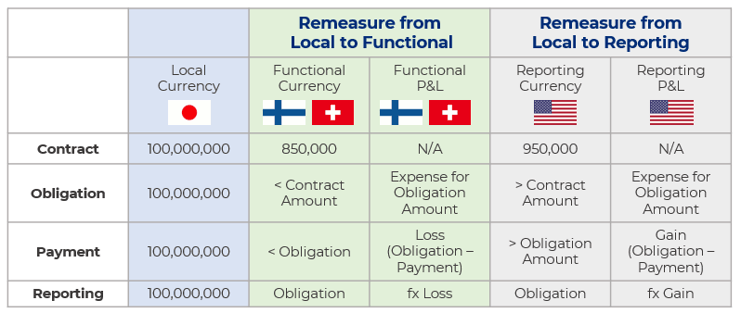

Building on the example above, let’s walk through what happens when the sequence is followed vs. when the transaction deviates from the sequence. The loan is 100,000,000 ¥. Between the obligation date and the payment date, the local currency strengthens against the functional but weakens against the reporting currency.

If the remeasurement was performed against the reporting currency, an invalid gain would be presented on the P&L.

In Conclusion

Given the global nature of business, many companies encounter foreign currency transactions. It is not uncommon that even a small entity has a rare, yet material transaction stated in a foreign currency. Regardless of the size of your entity or number of transactions, it is necessary the entire accounting function understand the fundamentals and implications of foreign currency transactions. In parallel with cementing your understanding of these transactions from an accounting perspective, an organization should ensure the transactions are continually aligned with the strategic and operational goals. For example, these goals may require hedging or multicurrency valuation capabilities which we will explore in future blogs.

At Veritas Total Solutions, we have experts in accounting practices especially as it relates to our Trading and Risk Advisory services. If you are interested in learning more about our specific capabilities, contact us to learn more or subscribe to our blog to stay connected!