The energy industry has endured two hard shots: the pandemic and breakdown in OPEC+ supply restrictions. The firms that succeed on the other side will be those that learn important lessons and strengthen their operations. This includes the risk management lessons of this difficult environment. Veritas believes that some in our industry have under-emphasized hedging and sound risk management frameworks, and that there is value in an objective benchmark against which to measure discretionary activities. Now is the time to take stock of what is working and not, and to formulate these policies for your firm’s return to growth.

Whether you are (a) long oil, refined products or another energy commodity, and evaluating how much of your forward sales to lock in or (b) naturally short, and looking to lock in your feedstocks or other commodity costs, or somewhere in between, this is is an excellent time to update your risk management and hedging policies.

Let’s take a look at the role hedging played in the recent price drops, why you should consider hedging as part of you risk policy framework and why now may be an ideal time to consider it.

How did we do during this price drop?

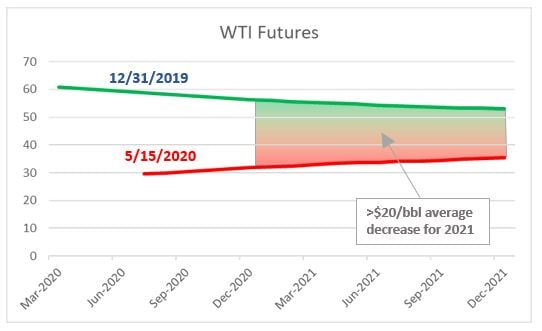

Recently the WTI futures contract for May 2020 delivery traded at negative prices several times during April 17-21, closing at minus $37.30/barrel on April 20. As I write this blog, the prompt contract (currently for June delivery), has crawled back above $30/barrel. When the prompt contract is whipsawed like this, longer term futures are usually less volatile. However, the entire WTI futures curve has dropped sharply during 2020. At the end of 2019, the average price for WTI delivery in 2021 was around $55/barrel. Currently, it is around $35, a $20/barrel decrease in value.

How much revenue does this represent to the US energy industry? The EIA projects that US oil production will continue decreasing during 2020 and 2021 to average 10.9 million barrels/day in 2021. At these forecast volumes, the $20/barrel decrease illustrated above represents an $80 billion loss to US upstream producers! Actual damages are worse, since the price drop also reduced forecast US supply by 11%.

But fortunately, most of us were hedged, right? Well, not so much. Firms are not required to report all details required to evaluate hedge performance, but most do not appear to hedge. According to IHS Markit’s 4Q 2019 survey of North American E&P firms, only 32% of oil production and 36% of gas production was hedged. As expected, proportions were higher for midsize and small E&P’s, which hedged 47% and 55% of oil respectively. Average protection was around $51/barrel, which sounds attractive in our current economic environment. However, some hedges were not entirely effective, for reasons that will be discussed further below.

So if 32% of oil production was hedged, 2021 losses were about $54 billion. That is a lot of avoidable pain, and in some cases bankruptcy.

What is the argument for not hedging?

There are various reasons stated by firms for not hedging. Some firms are philosophically opposed to hedging. There are several forms of opposition, including academic arguments or views that price changes tend to “average out.” The academic arguments usually involve assumptions such as “efficient markets,” lack of fees, and an unlimited number of trials. In the real world, there are significant costs to the employees and managers of a failed organization. Several large integrated energy firms, e.g. Chevron and Exxon, have been known not to hedge their production, reasoning that their stakeholders expect commodity exposure and that their balance sheets are strong enough to weather price storms. Some also feel that over any reasonable period of time, the gains and losses associated with price swings are a zero-sum game, which does not justify an active hedging program.

Other firms have insufficient capabilities to manage a hedge program. Some lack the risk analysis and other organization capabilities required to evaluate and execute hedges, monitor performance, etc. They may be focused on other priorities and not sufficiently compelled to insource or outsource the risk management function.

An alternative: Hedgulation

Other firms hedge when they believe there is a compelling market opportunity to do so. Veritas calls such programs “hedgulation.” They represent commercial trading activities in the guise of risk management. There is nothing wrong with commercial trades to optimize a firm’s assets, or to take advantage of market structure, but they should not be confused with a systematic hedging program. We believe there is value in having a robust, objective, policy governing hedging activities. Even if you rarely adopt the exact positions suggested by your risk policy, it provides a useful benchmark against which performance can be measured.

Harold Hamm, Continental Resource’s CEO, has publicly denounced oil hedging several times since 2014 when he unwound $433 million of profitable hedges. His statements normally include a bullish price outlook, essentially treating the hedge program as a large trading position. Continental’s public pronouncements that it wasn’t hedging oil are arguably a form of high stakes betting. The bet didn’t pay out during the 2020 price collapse, following which Continental curtailed 70% of its crude production.

Common examples of hedgulation include:

- Upstream organizations, as in the Continental example, that “hedge” when they feel the price is relatively high, but not when they are bullish, and

- Downstream organizations that occasionally (but not consistently) sell the crack spread forward, when market structure is contango and/or they believe that prices are likely to weaken.

In the risk profession, not typically known for humor, there’s an old adage that “if it loses money, it’s a hedge … if it makes money, it’s a trade.” Industry coverage of risk management often perpetuates this misunderstanding. For example, most coverage of Mexico’s large “Hacienda Hedge” usually emphasizes the $14 billion of “profits” that its hedge program has returned since it was initiated in 2005. The same coverage usually neglects to mention that Mexico’s oil sales lost more than the hedges returned, since only a portion of production was protected.

Should my firm revamp its hedging/risk policy?

In light of recent events, is this a terrible time to hedge? This may not be the best time to lock in a low price for all forward production. However, for example, it may be prudent to hedge 10% of next year’s production for $35/barrel. Alternatively, one could place good-until-canceled orders to sell at $40 or $45. Unless you are a lot better at predicting oil prices than other global participants in the WTI futures market, we believe it is important to have some sort of plan and take some action.

In particular, should your firm rethink its risk management policy? This is a time to be prepared. Establish an objective risk policy for how much of your production or refinery capacity will be hedged, as well as limits specifying flexibility around that policy. Zig Zigler is credited with saying that “if you aim at nothing, you’ll hit it every time.” Firms that take a subjective, discretionary approach to hedging have a very difficult time measuring performance. You will not know whether you are successful or unsuccessful if you do not have a specific policy.

Several examples of objective hedging frameworks are:

- An upstream firm could plan to hedge 90% of its forecast production this year, 75% next year, and 50% the following year. If commercial leaders elect to hedge more (or less) than this policy, this is permitted within established limits, and their performance can be viewed as short (or long) positions relative to the policy benchmark.

- Similarly, a downstream organization could have a policy to hedge all purchases and sales to the date of the refinery run (sometimes referred to as the “crack spread of the day”). Crude purchases that price in earlier than manufacturing (unless hedged), represent long positions. Product positions that price in later than manufacturing also represent product length. This process requires that physical and financial inventory exposure be properly distinguished.

From a trading perspective, you are taking a position whether you execute a hedge transaction or not. Sometimes lack of action can create a large and risky position. For example, unhedged production or priced inventory can both be viewed as a long position, in which you are betting that prices will be higher than those in the financial futures markets for your commodities.

It is critical that key stakeholders in the firm are aligned. If your executive team or owners are not on board, the best intentions of a risk management program will not matter. As described above, there is a lot of disinformation and confusion about hedging.

Veritas believes there is great value in a comprehensive risk management and hedging policy, as well as the discussion that surrounds it.

If I decide to hedge, how should I do it?

Alternatives should be evaluated in consideration of your specific business model. There is no need to reinvent the wheel, and you can learn from what other risk managers are doing in your industry. Some examples of analysis specific to your business include:

- What products are available and being used to hedge production or crack spreads in your supply chain? Example: is your offshore production well-correlated with Mars production or another liquid financial swap?

- Is it feasible to hedge certain NGL’s or chemical products more than 6-12 months forward?

- Should production be hedged at a fixed price or with “costless collars” which establish a floor and ceiling?

- Should options play a roll in your risk management program?

- What commodity or financial exposures are unwanted by your stakeholders? Example: if you aren’t a power company, perhaps you should hedge your power supply. If you mine gold, your shareholders aren’t investing in your stock for natural gas exposure.

However, it is also prudent to question common practice. Some products have enjoyed popularity but may not be appropriate for your hedging program. For example, an upstream hedge called the “three-way collar,” has enjoyed cycles in which it was in and out of favor. It provides less protection than other hedges during significant price collapses. It failed as a hedge during the 2014 oil price collapse, then slowly crawled back to some prominence as market participants became comfortable that oil prices were range-bound, then failed many firms again this year.

The best time for strategy

While things are beginning to look up, there may be more volatility ahead; therefore, we recommend taking a hard look at your risk policy to see how it performed and implement any lessons learned while they are still fresh. Finally, even if your organization wishes it had done an evaluation prior to the negative oil prices, remember the ancient Chinese proverb: “The best time to plant a tree was 20 years ago. The second-best time is now.”

At Veritas Total Solutions, our team of experts is versed in trading & risk advisory capabilities. We offer advisory services in commercial strategy, organizational structure and capabilities, and technology solutions. If you are interested in learning more about our capabilities, contact us to learn more or subscribe to our blog to stay connected!