What are Real Options?

Understanding and optimizing real options within your business can unlock massive value, which in many cases is being overlooked or underestimated. This blog will describe this opportunity and an approach for monetizing real options.

Very broadly, real options refer to any flexibility that management has related to business assets. For our purposes, we’ll focus on physical assets in the energy supply chain that cannot be financially traded, such as plants or pipeline infrastructure, but to which financial option theory and valuation can be applied.

In an earlier blog, Options Can Decrease Risk, we introduced examples of real options in the CTRM industry. Several types of physical assets which contain significant optionality include refineries, firm pipeline capacity, storage agreements, and extendable contracts.

Call to Action

In my first trading role, I received the advice, “Taking no action is still a position.” At the time, we were managing large crude cargos for a super major, and the business assets and contracts contained significant optionality. In one case, pricing of a crude cargo was determined by the month in which the cargo loaded; this was, effectively, a calendar option. This option was not useful to our physical operations, so we were not required to take action. However, we were long (i.e. owned) the real option, and not using or monetizing it would erode business value. We elected to monetize its value by selling financial options, netting on occasion several $million/month.

Some commodities trading organizations devote significant resources to the identification, measurement, and management of real options in their businesses. They also search for such optionality in M&A candidates. Firms that do not possess these capabilities are at a significant disadvantage to more sophisticated market participants. Can your organization be successful in today’s competitive energy markets without these capabilities?

The answer to this question depends primarily on the complexity of your real options. Fortunately, much can be achieved without best-in-class quantitative capabilities. In our experience, a moderate amount of options analysis and straightforward hedges (i.e. exchange traded futures and swaps) are all that is required in most cases. Let’s consider an example and then discuss organizational capabilities further.

Real Option Example

We’ll use a pipeline example as an illustration of monetizing a simple real option. It is widely accepted that owning or leasing firm pipeline capacity is equivalent to owning a spread option, whose value is based on market prices at the pipeline receipt and delivery locations. However, it is common hedging practice to ignore optionality and “lock” these spreads for the entire volumetric capacity.

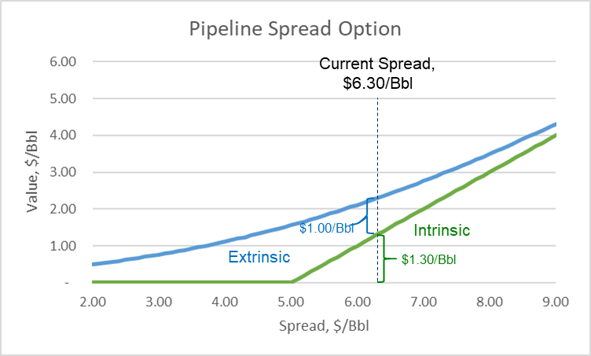

A better approach is to manage the entire value of the real option. The option value consists of the “intrinsic” spread described above, as well as the “extrinsic” value (aka time value), which derives from the possibility that spreads will improve in the future. As an example, we will consider a Midland to Houston crude pipeline with a $5.00/Bbl commodity charge. It will breakeven when the price spread is $5.00/Bbl, it will profit above this breakeven level, and it is not cost effective to use below the breakeven. As illustrated below, at a current spread price of $6.30/Bbl, the intrinsic value is $1.30/Bbl ($6.30 - $5.00), but extrinsic value is an additional $1.00/Bbl or 43% of the total value. In this case, if you can capture the full value of the real option ($2.30/Bbl), it is significantly more profitable than just hedging the intrinsic spread ($1.30/Bbl).

How is this accomplished? Options traders call it a “delta hedge,” which may sound daunting, but it only requires hedging a portion of the capacity by selling ICE futures based on the Houston price, while simultaneously buying Midland futures. The hedge size must be reevaluated daily or when the spread changes significantly.

Extending the above example, hedging this spread during November 2018 for the July 2019 delivery period, resulted in a $2.33/Bbl profit. This significantly exceeded the original intrinsic spread of $1.30/Bbl. Download the following for a detailed description of this hedge example.

A similar approach can be applied for many real options in the energy industry, including:

- chemicals plants

- refineries

- power plants

- biodiesel and ethanol plants

- a variety of types of transportation,

- contract extension rights,

- fuel or feedstock switching capabilities,

- storage

Any flexibility which is related to tradable financial markets may be a candidate for such optimization. Is your organization leaving substantial margin on the table? If so, what organizational requirements are needed to capture it?

Organizational Requirements

Next, we’ll turn to the people, process, and technology required to support the optimization of real options. Although the hedges described in the above example don’t require trading financial options, in some instances they may be required. Regardless, suitable option analysis capability is required in order to optimize the underlying real option. For these reasons, we recommend the following capabilities be developed at a minimum:

People (the right experience across the organization)

-

- Front Office: Option traders and supporting financial analysts

- Mid Office: Personnel with experience valuing options

- Back Office: Accounting personnel with options and derivatives accounting experience

Process

-

- Risk policy adapted to incorporate options hedging and/or trading

- Business process documentation of all trading, risk management, settlement, and accounting activities

Tools

-

- Options valuation and analysis tools

- Options enabled in applicable ETRM or corporate systems, e.g. deal capture, risk analytics, and general ledger

More complex real options require greater analysis capabilities, including a quantitative team. However, the additional value derived from these options can significantly exceed these additional investments. A benefit-cost analysis is required to assess your real options, as well as the gap between existing capabilities and needs. For more information about matching your policies, processes, organizational capabilities and systems to your risk management needs, see Too Little or Too Much: What is the Right Amount of Risk Management for your Company?

In summary

There is enormous value in real options associated with physical assets in the energy industry. Their proper optimization can contribute significant additional profits to your commercial business.

We don’t recommend trading options (or hedging real options) without the capabilities described. An upcoming blog will further detail these requirements.

This blog is part of a series covering Options. The other blogs in this series include:

- Options Can Decrease Risk

- Organizational Capabilities for Options Trading – coming soon!

- Selecting the Right Options Valuation Model – coming soon!

At Veritas Total Solutions, our team of experts is versed in options and other trading & risk advisory strategies and services. We offer advisory, organization diagnostics, and strategic services in this area. If you are interested in learning more about our specific capabilities, contact us to learn more or subscribe to our blog to stay connected!