How much of your company’s revenue comes from contracts? For most energy companies it is 100% or close to that. It is important to know that General Accepted Accounting Principles (GAAP) has changed and impact the standards for revenue recognition around contracts with customers. Improper recognition can lead to disastrous results both financially and reputationally.

It is critical for you to know the rules and define your company’s practices. It is equally important to put the right supporting processes and technologies in place. An approach that purposefully incorporates knowledge, process, and technology will validate decisions and ensure you are recognizing revenue accurately.

Understand

Currently, Accounting Standards Codification (ASC) 606 states revenue can be recognized when control of goods or services is transferred. This departs from the previous "…transfer of risk and rewards" concept. This definition seems clear, however, there are pitfalls.

Distinct Good or Service(1)

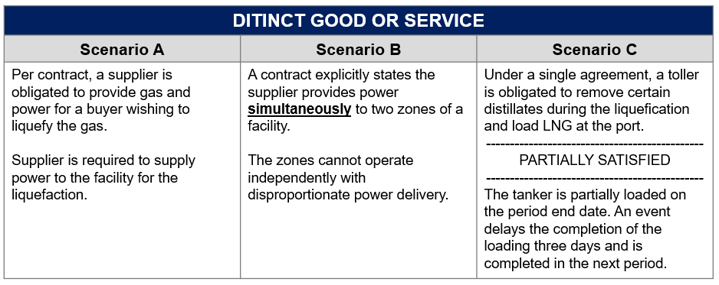

A contract may include multiple performance obligations (delivery of different commodities, performance of a service and providing a good, bundled services, etc). It is not uncommon for physical energy contracts to contain these layered elements. In these instances, a distinct good gets different revenue treatment. In Scenarios A, B, and C below, is each delivery distinct enough to be a stand-alone promise to perform, or merely a component within a single performance obligation?

Partially Satisfied Obligation

There are instances whereby performance may be partially satisfied. In this circumstance, the concepts of distinct and control are both in play. The standard outlines if the good and be used or sold for greater than scrap value, has economic substance, and can be used on its' own or with other available resources (2), revenue may be recognized. In Scenario C below, is the buyer in control at period end?

The interpretation of the elements within the standard can lead to different conclusions and applications of the standard for each scenario, resulting in accelerated or postponed revenue recognition.

Define

When to recognize revenue is at the discretion of the company's accounting group and executive management. Knowing the landscape gives leadership clarity over how to move forward. It’s critical to have defined standards that can be followed consistently. In some cases that standard might mean a process by which management evaluates possible choices, the impacts, and gets formal approval on the best choice.

Consultation with external financial resources (audit firms, accounting subject matter experts or industry publications) can guide management through transaction nuances or complexities. Seeking external assistance evidences that management is diligent and mindful in presenting accurate financial results.

Enable

Often companies have clear revenue recognition standards, but disaster strikes trying to implement those standards. Lengthy month end and financial processes and material misstatements arise from poor processes and incompatible solutions. The key is aligning your processes and technology with your standards from beginning to end. Do not just try to fix everything manually in the back office.

Contract Management

Commercial terms are crucial to properly accounting for revenue. Does the contract clearly identify title transfer and pricing terms? Are those terms captured properly in your system of record? Do you have a controlled process to ensure consistency?

Recording Events

Often a contract is clear on title transfer, but organizations fail to accurately capture that title transfer event. In some cases, the organization fails to record the event as part of their standard business process. This can occur if it is an atypical title transfer event. In other cases, the logistics or accounting solution is not configured to record the event. We often see this with water borne movements and title transfer at locations (e.g. international water) and vessel events such as NOR (Notice of Readiness). It can happen with other forms of movements as well including rail, truck, and pipeline.

1. Accounting: Proper solutions can generate timely journal entries and clear reports. The key is a solution that is set up to work seamlessly with contracts and logistics data and recognize revenue events and record them appropriately. This seems daunting but numerous off-the-shelf commercial systems are built with this functionality. The key is choosing the right one and setting it up appropriately for your business needs and organization’s processes.

2. Review and Sign-off: A complete process includes procedures to review activities, personnel, and results tangent to a revenue event. The review process should include personnel able to understand the transaction and identify errors or inconsistencies. A single event may be reviewed due to its’ risk or materiality. A monthly multiple transaction review may be requisite to validating period results, while unscheduled reviews or audits may occur to validate compliance. Your system should facilitate transparent reports that enable those reviews and audits.

Final Note

With the need to access clear and accurate records, manage timely reporting, drill down to granular events and transactions, monitor the processes and policies of the company, and abide by prevailing standards, recording revenue should not be an overlooked task. Companies both seasoned and new can incur difficulty in ensuring revenue is recognized properly. That is why it is vital to ensure the company knows the rules, makes informed decisions, and has the processes and tools necessary to support those decisions.

References

- (1) ASC 606-10-25 (14-19)

- (2) ASC 606-10-25 (20)

- (3) ASC 606-10-55 (378)

At Veritas Total Solutions, we have experts in accounting practices especially as it relates to our Trading and Risk Advisory Services. If you are interested in learning more about our specific capabilities, contact us to learn more or subscribe to our blog to stay connected!