The role of a credit risk manager in an energy or commodities supply & trading organization is challenging on many fronts. We live in difficult economic times, which are threatening the viability of businesses throughout the supply chain. The quantitative data needed to effectively perform the credit management function is not always available. In Veritas’s experience, there is a wide variety of approaches to credit risk management (see approaches in the Four Components of Credit Risk Analysis blog for discussion of industry approaches). Many firms in our industry have the opportunity to improve their credit risk management practices, and never has there been a more critical time to do so.

This blog will overview credit risk management by introducing some necessary terms and relationships and then outlining an overall framework. Lastly, we will also provide a roadmap to additional, more detailed credit risk management blog readings.

Taxonomy of Credit Risk Management

In practice, credit risk management terms and process descriptions vary in our industry. We believe semantics and choice of terminology are of little importance, as long as your risk management framework is internally consistent and comprehensive.

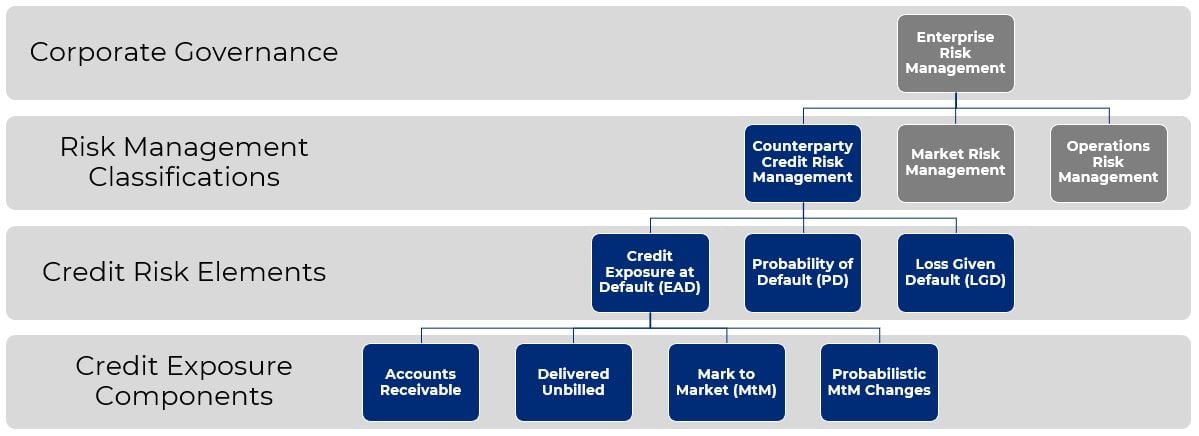

The blue boxes in the diagram below illustrate a comprehensive approach to Credit Risk Management and its parts, within the broader context of Enterprise Risk Management. We will walk through each, one level at a time, with more focus on the credit-risk-related blue boxes.

Illistration 1: Taxonomy of Credit Risk Management

Illistration 1: Taxonomy of Credit Risk Management

At the highest-level Enterprise Risk Management is described by the Enterprise Risk Policy (ERP). The ERP is a primary governance document, on par in many firms with Commercial Strategy and Ethics policies. It is best practice to integrate credit, market, and operations risk management under a single policy and governance structure, although in practice many firms separate these. For example, firms that only track the credit risk associated with accounts receivable often locate their credit risk functions in Finance or Treasury rather than the Risk Management or Control team. We will cover comprehensive risk management policies in detail in our upcoming blog.

Risk Management Classifications

Enterprise Risk Management encompasses several risk management “classifications”. For our purposes, we simplify these into three distinct groups:

- Counterparty Credit Risk Management – The probability of counterparty default, this is our focus in this blog series. We break this down further in the rest of the blog.

- Market Risk Management – While primarily focused on price risk, market risk also includes changes in other market-related factors such as volatility, correlation, and liquidity.

- Operations Risk Management – For our purposes, we will consider Operations Risk as “everything else that poses risk” that is not covered by credit or market risk. This can include but is not limited to compliance risk, human error or malfeasance, system breakdowns, acts of nature, geographical risk, cataclysmic events such as war or pandemics, and reputation risk. Some of these can be insured, and some may be areas of major focusses.

Credit Risk Elements

In turn, Counterparty Credit Risk entails the following elements:

- Credit Exposure at Default (EAD)– the actual or estimated amount, expressed as a value in some currency, which is at risk in the event of a counterparty’s credit default. The elements which contribute to Credit Exposure are further broken down below.

- Probability of Default (PD) – the risk a counterparty will default, usually assessed over a particular term, e.g. 1, 2, 3, or 5 years, 1 year being somewhat standardized.

- Loss Given Default (LGD) – the percentage of the Credit Exposure amount that will not be recoverable in the event of a default. LGD is complimentary to percentage recoverable (i.e., LGD = 1 – the percentage recoverable).

Expected credit loss is a multiplicative product of these elements. For example, if a particular counterparty has a $22m exposure over a 1-year time frame, a 5% probability of default, and an estimated 80% loss given default, then its expected credit loss is $880k for that counterparty ($22m x 5% x 80%).

Credit Exposure Components

Not all firms utilize all three elements within their credit risk analysis, but most calculate one or more of the four credit exposure components described below.

- Accounts Receivable – the unpaid total of invoices for a given counterparty. If a bilateral netting agreement is in place between your firms, the invoices receivable would be netted with the amount that your firm owes the counterparty (often called "net receivables")

- Delivered Unbilled – the value of commodities that have been delivered and for which the counterparty is obligated, but not yet invoiced

- Mark to Market (MtM) – the difference between contracted and market value of commodities which have not been delivered

- Probabilistic MtM Changes – in addition to the current MtM, the possible change in MtM that may increase or decrease credit exposure. Usually, this is estimated with a simulation such as Potential Future Exposure (PFE) or Credit Value at Risk (VaR).

Credit limits are typically established for each counterparty, and utilization of those limits can be determined using either Credit Exposure or Expected Loss. Credit collateral, guarantees, or other security can be posted by the counterparty to reduce their net utilization of their limit and provide space for additional business.

Another useful twist to credit risk and credit exposure analysis is that it can be applied in both directions – you can use the same framework to calculate your perspective of your counterparties’ risks, as well as their assessment of your risk to them. This becomes even more important in cases where there is no netting involved. In the case of default by the counterparty, the entity will still be obligated to adhere to its commitments.

Conclusion

Obviously, there are a lot of details behind this summary, but we hope you find this organization of the subject helpful. Other blogs have (or will have) fuller treatment of the levels of credit analysis described above, as well as other related dimensions. These include:

- Four Components of Credit Exposure – live!

- Credit scoring best practices – coming soon

- Credit risk management systems – coming soon

- Credit risk advanced analytics – coming soon

- Credit collateral management – coming soon

- Credit default and recovery risk – coming soon

As usual, don’t hesitate to contact us if you have other questions about this material, as well as alternative points of view.

At Veritas Total Solutions, our team of experts is versed in trading & risk advisory capabilities. We offer advisory services in commercial strategy, organizational structure and capabilities, and technology solutions. If you are interested in learning more about our capabilities, contact us to learn more or subscribe to our blog to stay connected!