The hedging standard (ASC 815) has been updated and these updates are effective for fiscal years ending after December 15, 2018* (for public entities). If your company has a hedging program, these updates can significantly influence how you present these instruments on the financials, and how you can more prudently manage risk. If your company does not have a hedging program, these updates can influence your company’s decision to apply hedging.

*Some clarification on the date: If a company has a year-end on December 15, 2018, the company must implement the updates in the current year-end financials. If their year end is before the 15th (i.e. December 14th), they are not obligated to (but can if they choose) apply the changes in the current year-end financials. For all companies with year-end dates past the 15th, they have 60-90 days after its’ year end to file it's report so technically the “deadline” is Feb 28th 2019 (based on a company that has 75 days to submit its’ financials).

What is the Update?

ASU 2017-12 and ASU 2018-16 officially modify ASC 815. The update is expansive, covering various aspects of the standard. Included in the update are key changes to the following:

- Presentation of hedging instrument in earnings

- Benchmark indices used to hedge interest rate risk

- Hedging against specified components of a contract

- Measurement and disclosure of hedge ineffectiveness

- Treatment of interest rate risk hedges on pre-payable financial instruments

- Timeframe to perform quantitative and qualitative hedge effectiveness assessments

- Required disclosure verbiage and presentation; Presentation of supplemental information

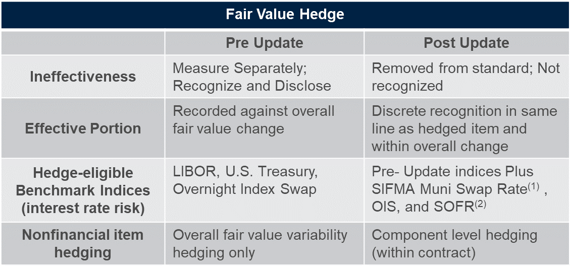

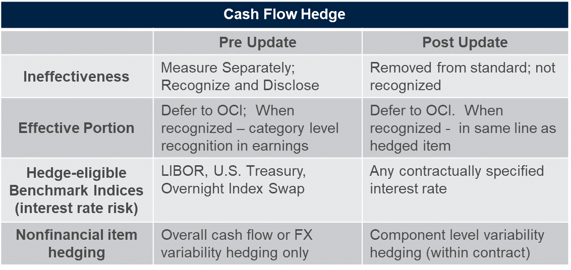

The bullets above present only a portion of the changes across the standard. The figure below depicts a comparison of the standard before and after of some of these changes.

References: (1) FASB ASU 2017-12 (2) FASB ASU 2018-16

References: (1) FASB ASU 2017-12 (2) FASB ASU 2018-16

The impact of these changes is unique to each company. Each change may result in additional or reduced efforts across measurement, monitoring, presentation and/or disclosure around hedging instruments. Synthesizing impact and effort can help a company determine a course of action.

Leveraging Changes

Before a course of action is finalized however, a company must be careful to target only their required updates. It can be a challenge to identify and properly apply relevant changes. Making an unnecessary change is unproductive. A worse-case scenario is incorrectly interpreting the update, mis-applying changes to company records, and presenting incorrect financial information. There will be significant money, time, personnel and perhaps external effort required to reverse and correct this information.

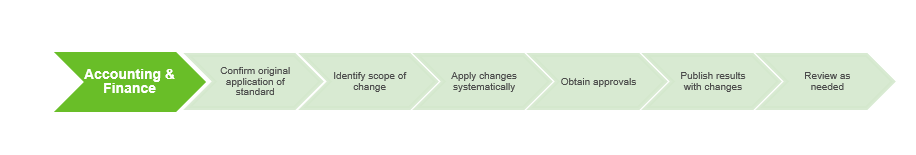

Given the intricacies and importance of this standard, a company needs a structured, strategic approach around making applicable changes against the update. A simple framework encompasses the standard changes and outlines a plan to strategize future hedging activities against the changes.

Accounting and Finance (Application Track)

-

- Confirm original application of standard (published financials)

- Identify scope of applicable changes within ASU 2017-12 and ASU 2018-16

- Segregate retrospective and prospective changes

- Perform retrospective changes to prior period financials as needed

- Execute changes to current period, including disclosures and supplemental information

Risk Management (Strategy Track)

-

- List advantages and disadvantages to standard changes

- Identify new or improved hedging opportunities as an outcome of changes (within risk management strategy)

- Simulate proposed strategy

- Obtain consensus across Risk, Finance, and Compliance

- Proceed with hedging program

- Monitor in accordance with internal risk polices, accounting policies, and external governing bodies

Supporting Your Efforts

Performing accounting and risk management duties for a hedging program can be difficult. It is vital to understand hidden areas of financial risk that can now be mitigated through the update. It also takes cross-functional coordination to apply a strategy inclusive of strong policy guidance, clear processes, and capable technical solutions, that can also empower leadership to make prudent decisions.

That is why risk management and accounting experts are beneficial to get your company on the right path. As your company prepares for the hedging updates and future updates on the horizon, make certain you have an ally to support your goals. This is just the first article of a three-part series, Essential Accounting Updates. Our other two articles include How Can Benefit from the Recent ASU for Cloud-Based Hosting and The Right Approach to Revenue Recognition.

At Veritas Total Solutions, we have experts in accounting practices especially as it relates to our Trading and Risk Advisory Services. If you are interested in learning more about our specific capabilities, contact us to learn more or subscribe to our blog to stay connected!