The Cloud has been and continues to be a management service solution technology used across all industries. No matter what industry or department you are in, chances are you use some amount of technology in the Cloud. More and more companies are choosing to move to cloud-based computing arrangements (hosting) over on-premise to take advantage of reliability, speed and security provided by this technology.

Accounting practices have to keep up with the emergence of the Cloud. Now, cloud-based hosting for newly implemented internal systems has defined accounting guidance. It’s important for all c-suite executives to understand this change as it can materially impact financials and the business decisions made from these financial results. Let’s take a deep dive into the latest Accounting Standards Update related to cloud-based hosting and its’ implications on business strategy and planning.

A Quick Lesson in Accounting Standards

The FASB Codification issues Standards to provide structure and consistency around how to treat business transactions. The Standards have been constantly evolving to keep up with and be inclusive of the latest technologies. Due to the emergence of cloud-based hosting arrangements – including SaaS, PaaS and IaaS – the Codification has been updated to be more inclusive of all these hosting arrangements.

FASB Codification Standard 350-40

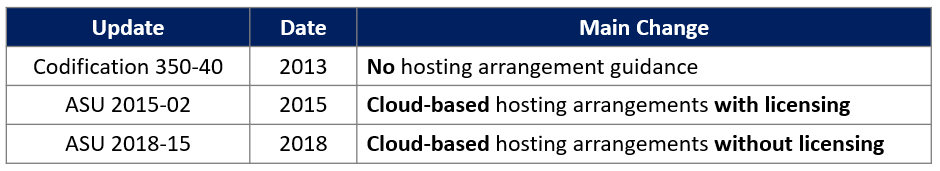

FASB Codification Standard 350-40 was (and remains) the prevailing guidance related to internal use software implementations. An example of internal use software may include Oracle, SAP, or Allegro. However, the guidelines did not specify the treatment of Cloud-based arrangements for internal use software implementations. The ambiguity led to accounting inconsistencies across companies.

ASU 2015-02

Since Cloud-based hosting arrangements were not clearly defined, the FASB updated 350-40 with ASU 2015-02. This update addressed internal-use software cloud hosting arrangements that included licensing. Even with this update, the standard remained silent on the treatment of service-only hosting arrangements (without a license agreement). For example, a company implementing an ETRM solution with ETRM vendor hosted services and no licensing agreement for software usage would be categorized as a service-only hosting arrangement and not subject to this update. The lack of clarity allowed companies to apply different accounting treatments to the same transaction. FASB recognized the different applications of this service obscures comparability across companies and consistency within a single company.

Understand the Latest Update: ASU 2018-15

The purpose of the latest Accounting Standards Update 2018-15 is to provide guidance on the treatment of Internal use software implementation with cloud-based hosting arrangements without licensing arrangements. ASU 2018-15 specifically addresses the accounting treatment for internal-use implementation hosting costs without an attached software license. This service-only arrangement considers the nature and timing of services to identify what to capitalize. The update gives companies clear guidance on how to apply certain hosting arrangements in an implementation. This results in decreased efforts in determining how to account for certain hosting arrangements. The guidance also facilitates consistency and comparability within the financials. Let’s dive a little deeper into some specific areas related to the update.

Accounting Treatment: Capitalize Costs only if During Application Development Phase

Unlike earlier versions of the ASU, the latest one is very specific about when costs can be capitalized and when they cannot. In a project, there are three core phases: preliminary project, application development phase and post-implementation phase. Capitalization can only occur during the application development phase of a cloud-based hosting on an internal solution implementation. The application development stage is the period whereby the software solution is actively being created, developed, configured, or tested and any associated training to facilitate these activities.

If the service is performed during a preliminary project or post-implementation phase, guidance dictates that costs are expensed as incurred. If the arrangement is performed during the application development phase, costs are generally capitalized and amortized over the term of the arrangement. This can be beneficial to the project since you can allocate your expenses over a longer period of time (the contract period), which can influence critical financial ratios.

Amortization Period: Identify Your Arrangement Term

In this case, the service contract is classified as an amortizable intangible asset. Every company should exercise diligence in identifying the arrangement term for which the amortization is applied against the capitalized costs. A term includes the contractual noncancelable service period and any one of the following optional periods:

-

-

- Extension period, if reasonably certain to exercise

- Extension period, if optional termination is reasonably certain not to be exercised

- The extension period or option to terminate is controlled by the vendor

-

Payment and Cash Flows: Place Fees and the Hosted Solutions in Same Cash Flow Category

As these costs are amortized, the expense should be reflected in the same line item as fees related to the hosted solution. Payments associated with these costs should be presented on the statement of cash flows in the same category as the hosted solution.

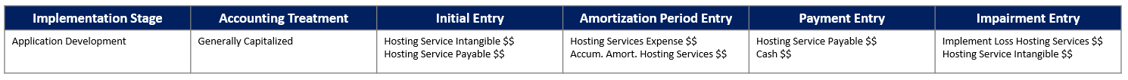

The figure below provides an example on how activities within the Application Development stage are journalized, including the periodic amortization entry.

Take Action: How and When to Prepare for ASU 2018-15

How to Prepare

The biggest takeaway is if your company is planning to or currently implementing an internally used software solution and has a cloud-based hosting arrangement without a licensing agreement, you now have more clear and precise rules to follow, and if done strategically, you could benefit from this update. Being aware of some caveats of the rule, like the nature when the hosting fees are incurred, can help you devise methods to better navigate these changes. Remaining aware of accounting updates allows a company to prevent unnecessary and time-consuming accounting corrections and be more strategic at upfront budget planning.

When to Prepare

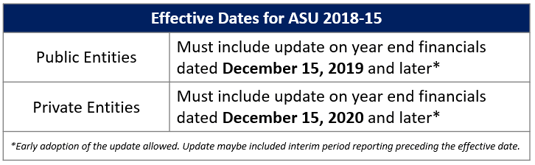

The update was issued in August 2018 and effective for public (SEC) companies for year-end reporting periods after December 15, 2019. Therefore, public companies with a year end after this date must include the updated standard in its annual reporting. i.e. If your year end is December 31, 2019, you must include this in your 2019 year-end reports. This gives companies have ample time to perform evaluation of their hosting contracts if they are currently or expected to engage in an implementation in the future. Establishing a process to correctly capture these costs will avoid the pain of making corrections.

We recently published a related article, ASC 815 Impacts End-Of-Year Financials, as part of our Essential Accounting Updates Series. To remain aware of the current standard changes that may affect your company and methods to manage these changes, check out The Right Approach to Revenue Recognition.

At Veritas Total Solutions, we have experts in accounting practices especially as it relates to our Trading and Risk Advisory Services. If you are interested in learning more about our specific capabilities, contact us to learn more or subscribe to our blog to stay connected!